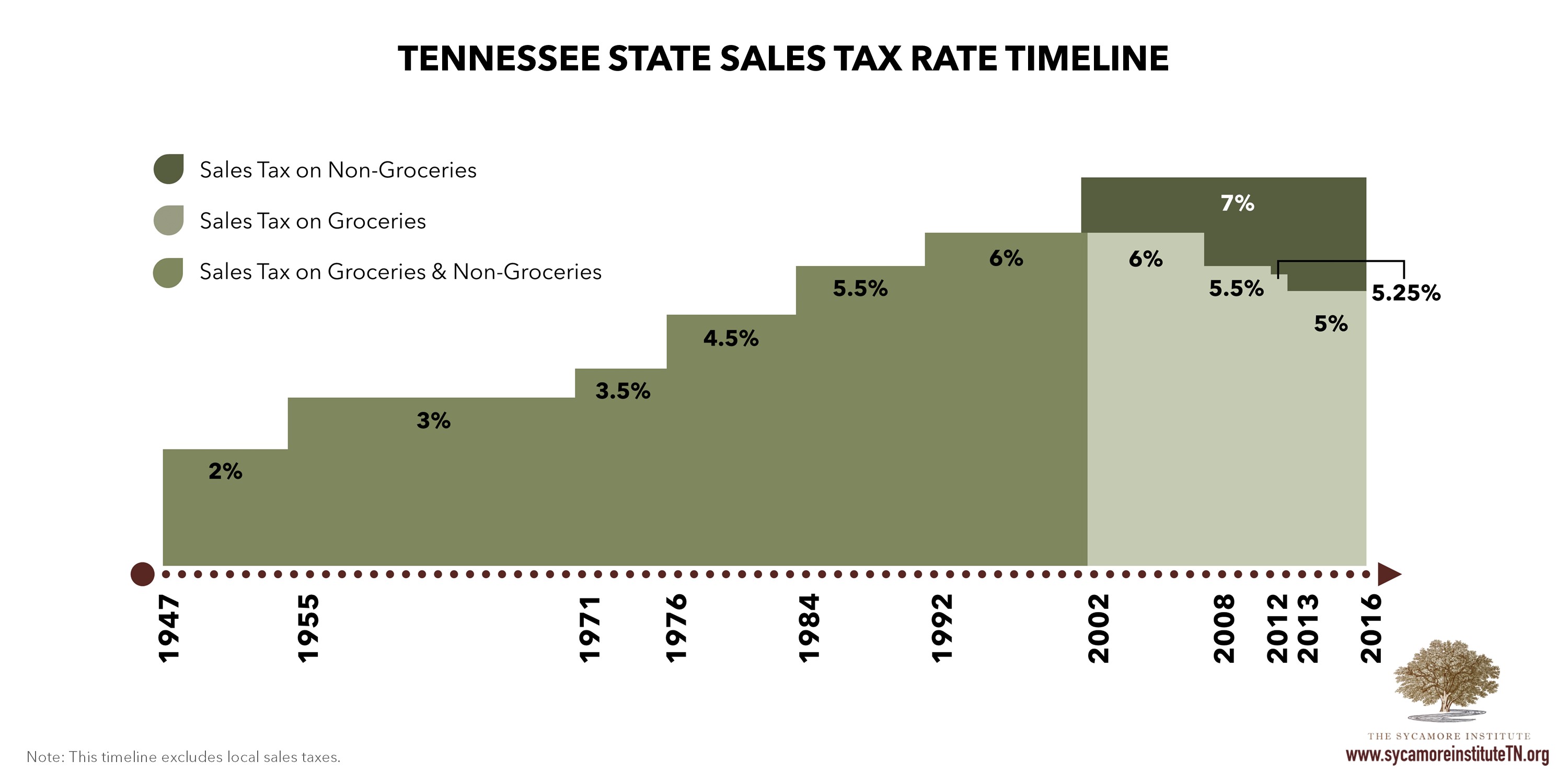

Tennessee Sales Tax 2025. Many governments exempt goods like groceries; Tennessee tax changes effective july 1, 2025.

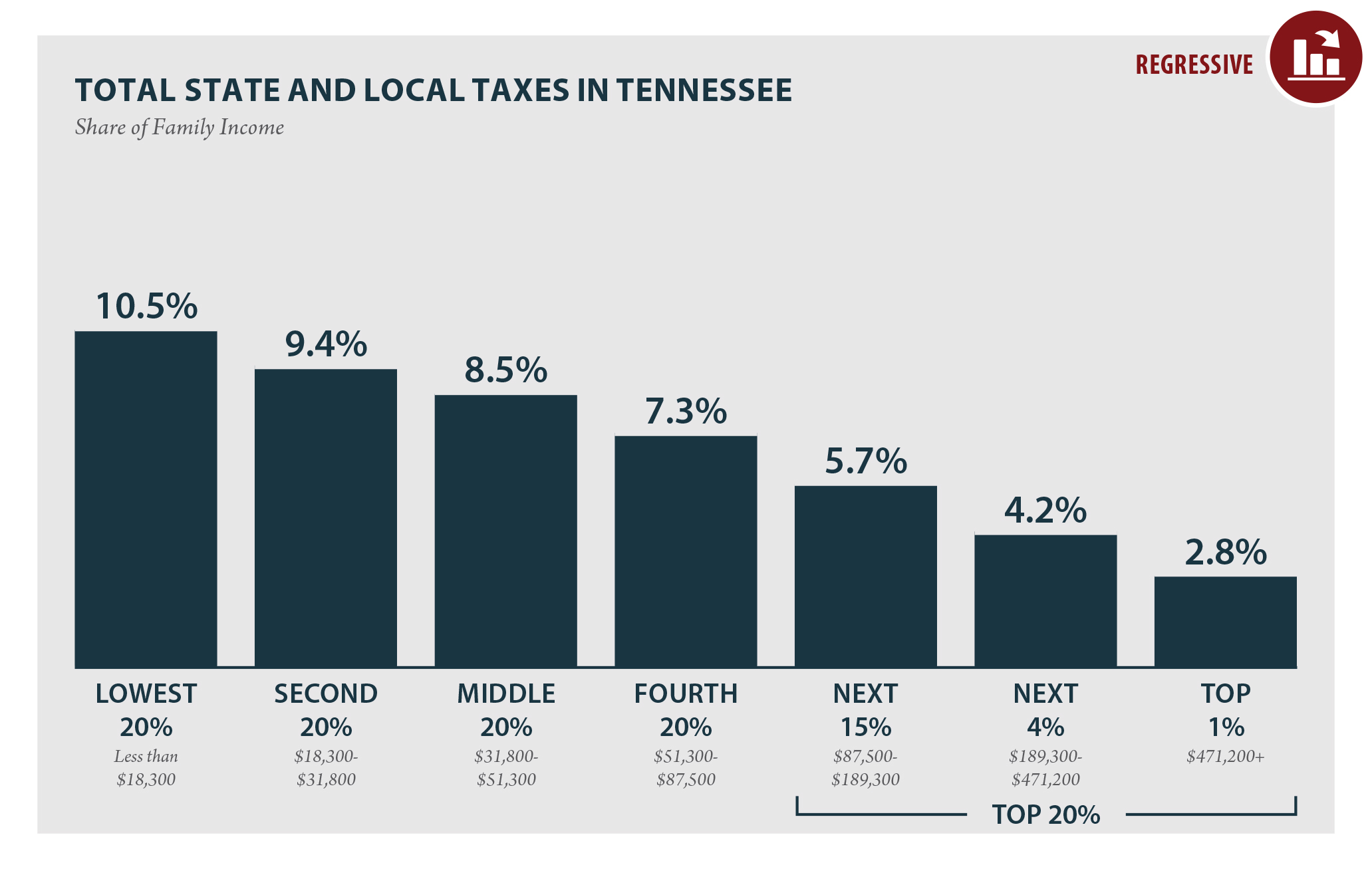

The sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. The morgan county, tennessee sales tax is 9.00% , consisting of 7.00% tennessee state sales tax and 2.00% morgan county.

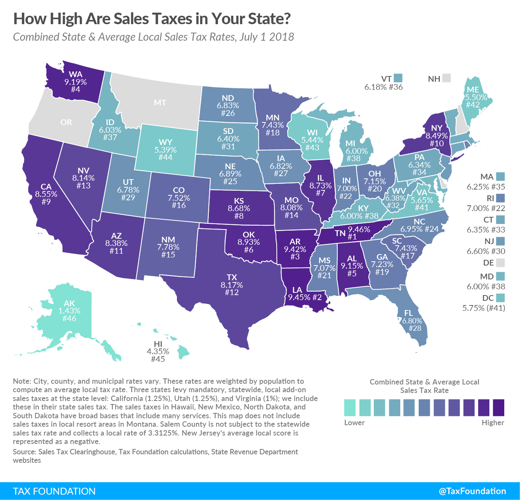

Tennessee Now Has the Highest Sales Tax in the Country Pith in the, You can use our tennessee sales tax calculator to look up sales tax rates in tennessee by address / zip code. Base broadening, such as including.

Tennessee Sales Tax Calculator State, County & Local Rates, Over the past year, there have been four local sales tax rate changes in tennessee. The tennessee sales tax is 7%, so taking advantage of a tennessee sales tax holiday to buy $500.00 worth of goods would save you a total of $35.00.

Tennessee Sales Tax Calculator Step By Step Business, Our free online tennessee sales tax calculator calculates exact sales tax by state, county, city, or zip code. If you make $70,000 a year living in new hampshire you will be taxed $7,660.

How the Sales Tax Works in Tennessee YouTube, There are a total of 310 local tax jurisdictions across the state, collecting an average local tax of 2.617%. Subjecting hydrogen gas to the compressed natural.

Tennessee Sales Tax Regulations on the Sale of, Subjecting hydrogen gas to the compressed natural. Exemptions to the tennessee sales tax will vary by state.

Tennessee State Budget Primer (with Nov. 2017 Update), There will be a potential tax credit through dec. Tennessee (tn) sales tax rates by city.

Sales Tax in Tennessee Sales and Use Tax Tennessee, The sales tax rate on food is 4%. If you make $70,000 a year living in new hampshire you will be taxed $7,660.

Tennessee sales and use tax guide Fill out & sign online DocHub, Exemptions to the tennessee sales tax will vary by state. There are a total of 310 local tax jurisdictions across the state, collecting an average local tax of 2.617%.

Agriculture Machinery, Equipment, Technology in India Shop It, You can use our tennessee sales tax calculator to look up sales tax rates in tennessee by address / zip code. This comprises a base rate of 7% plus a mandatory local rate that varies by.

Understand state sales tax nexus QuickBooks, 31,2025, for employers paying paid family and medical leave. Tennessee has state sales tax of 7%, and allows local governments to collect a local option sales tax of up to 2.75%.